LONDON: Despite warning from analysts, US President Joe Biden finally announced the release of crude oil from the country’s strategic stockpile, a unilateral move first mooted by his Energy Secretary Jennifer Granholm in October, as he seeks to curb inflationary pressure in the US economy.

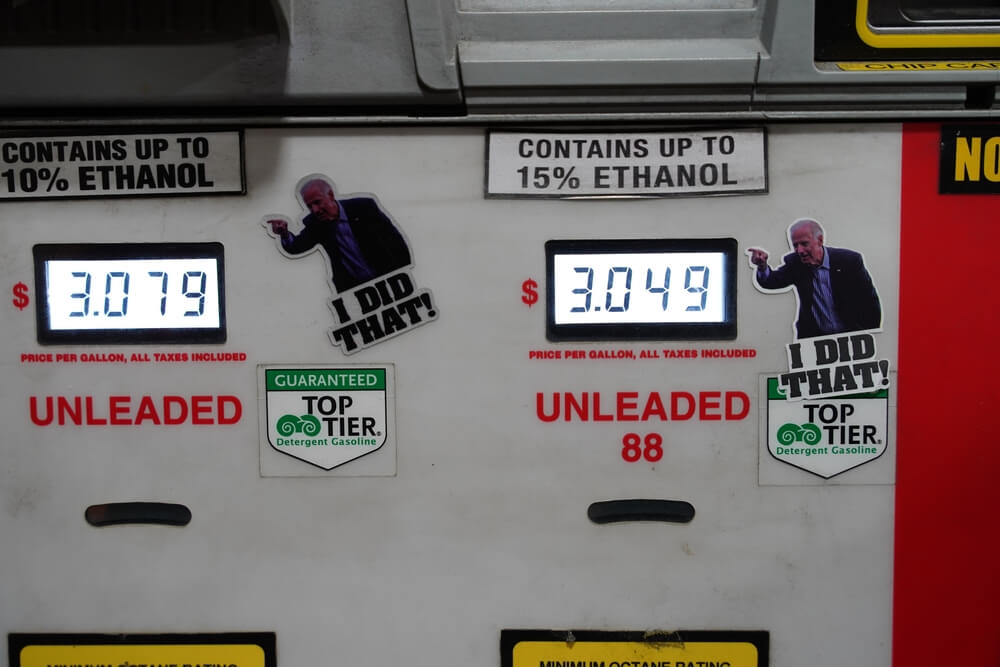

Gasoline prices nationwide are averaging about $3.40 a gallon, more than double their price a year ago, according to the American Automobile Association.

Biden confirmed the release from the US Strategic Petroleum Reserve on Tuesday after months of failed pressure by the President to convince OPEC to hike production amid rising gasoline prices in America – currently at a seven year high – and heightened worries that rising inflation could derail the post Covid-19 economic recovery.

The move, which will make 50 million barrels of oil available from the SPR in conjunction with releases from China, India, Japan, South Korea, and the UK, underlines the intense domestic pressure the President is under as his poll ratings tumble.

The Indian government also announced it would release 5 million barrels of oil from strategic reserves in coordination with other buyers.

The rules of the International Energy Agency (IEA) – the inter-governmental group charged with managing global supply – specifically state that reserves should only be released to manage market shocks, such as wars or natural disaster, not as a mechanism to correct market imbalances caused by lack of investment and rising demand.

Natasha Kaneva at JP Morgan said the unilateral emergency sale from the SPR, without coordination with the IEA, was unprecedented.

She said: “Presidentially-directed emergency releases have occurred only three times over the last 30 years and all happened before the US shale revolution significantly reduced US dependence on imported crude.”

It is also the first time the US has involved China in any coordinated action to release oil reserves, although China, which is only an affiliate member of the IEA, has so far failed to release all the details of its release.

Giovanni Staunovo at UBS described the release as a “big headline number” but added that the “details provide a less strong narrative”.

He said: “Fifty million barrels from the US is above the market expectations, but the effective volume is much smaller, only 32mb. Moreover,18mb of the 50mb were already planned to be sold next year, now this amount is sold at the start of the year instead of later in 2022.”

He added: “Also the amount being so far mentioned from other countries joining the US looks more symbolic.”

The Strategic Petroleum Reserve was created after the 1973 energy crisis. Two sites in Louisiana and two in Texas currently hold oil in caverns hollowed out of salt domes — mountainous salt deposits that are almost entirely underground.

The most obvious risk in releasing reserves, as Goldman Sachs commented in a recent note, is that it can only offer a short-term solution to Biden for what is clearly a structural problem in the market.

However, a bigger immediate issue will be how OPEC+ responds when it meets next week. Will the organization now decide to adjust its planned oil production increases?

Most market analysts suggest OPEC is more concerned about the prospect of renewed COVID-19 restrictions in Europe, but add Biden’s decision does provide an opportunity for the organization to downwardly revise its current production levels.

UBS’s Staunovo said: “They (OPEC+) will closely track the developments on mobility restrictions in Europe. That is probably their biggest concern at the moment and increasing the probability that they might pause at the next meeting.”

OPEC+, which comprises OPEC members essentially led by Saudi Arabia and other producers led by Russia, has so far doggedly stuck to its strategy of increasing production by 400,000 barrels per day each month.

OPEC has been wary about opening up the taps amid fears that a worrying spike in COVID-19 rates in Europe and the US could result in fresh economic restrictions.

Austria returned to a full lockdown this week, while the Netherlands is currently in a partial shutdown. Germany is considering the imposition of regional lockdowns as infection rates spiral and Italy is poised to introduce tough restrictions for non-vaccinated people.

Virus cases are rising across the US at a rate of almost 100,000 a day, a trend that prompted the US government’s chief medical adviser, Anthony Fauci, to warn of “dangerous” new surge of infections as Americans prepare to travel across the country for this week’s Thanksgiving holiday.

Government restrictions to prevent the spread of COVID-19 deliberately suppress economic activity while fear of the virus reduces consumption. But even without further restrictions there are increasing concerns about the slow speed of the post pandemic economic recovery.

It is against this backdrop that OPEC+ believes demand is not yet strong enough to justify increased production and be shifting towards a reduction.

Indeed, figures from the International Energy Agency indicate OPEC+ production is 700,000 bpd less than planned during September and October, a shortfall largely attributable to Angola and Nigeria.

The sharp decline in industry investment, a symptom of environmental pressures on oil majors in the shape of environmental, social and governance concerns, has left many producers, with the exception of Saudi Arabia, the UAE, and Iraq, unable to pump more.

It is worth bearing in mind that the so-called “sweet spot” for global crude prices is currently thought to be between US$75 to $90, a price that is seen to provide sufficient revenues for producers, while not at a level to hurt demand or encourage investment in other forms of energy.

Oil ticked up slightly following the release announcement to almost $80.

The other danger for Biden is that releasing reserves may well be seen by the American public as the very least he could do. Reversing his decision to revoke the Keystone XL Pipeline and his suspension of new oil and gas leases on federal government lands would prove a good deal more effective in sending the market a message.

Speaking earlier this month in Abu Dhabi, the chief executive of US oil firm Occidental Petroleum said Biden should ask domestic shale producers to increase production rather than the OPEC+.

US Republican Sen. John Barrasso, echoed that view. “President Biden’s policies are hiking inflation and energy prices for the American people. Tapping the Strategic Petroleum Reserve will not fix the problem. We are experiencing higher prices because the administration and Democrats in Congress are waging a war on American energy.”

Prior to the pandemic, the US shale industry was seen as the world’s swing producer, and had even turned the US into a net exporter.

While oil production from the Permian Basin, the largest US shale field, is set to surpass its pre-pandemic record next month, overall shale output is below its boom years of 2018 and 2019 amid inflationary pressures, labor shortages, and some banks charging higher interest rates on loans for fossil fuel than green projects.

Against that backdrop, one could argue some US producers appear to be as unwilling to ramp up production of crude oil to levels that would lower prices at the pump as OPEC+.